All Categories

Featured

Table of Contents

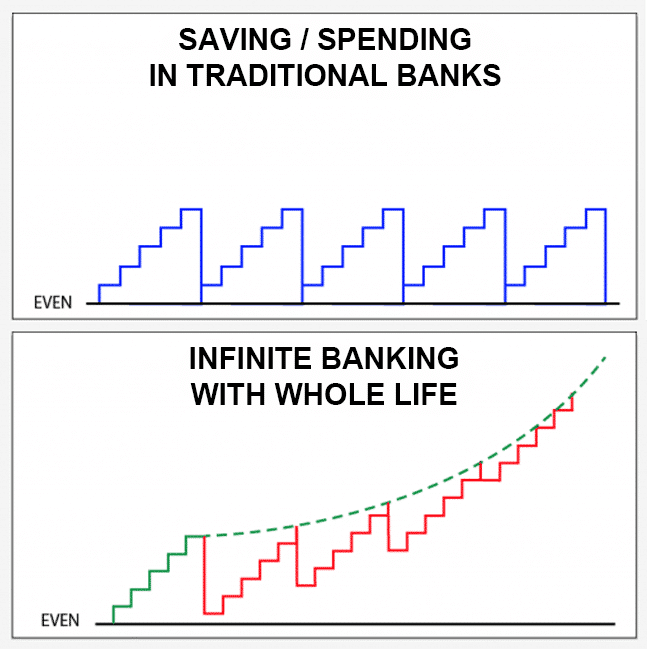

The drawbacks of limitless financial are typically overlooked or not pointed out whatsoever (much of the details available about this principle is from insurance policy representatives, which may be a little biased). Just the cash worth is growing at the reward price. You also have to pay for the cost of insurance coverage, costs, and costs.

Business that supply non-direct acknowledgment car loans might have a lower reward price. Your money is secured into a difficult insurance policy product, and abandonment charges generally don't disappear until you've had the policy for 10 to 15 years. Every long-term life insurance policy policy is various, but it's clear a person's general return on every dollar invested on an insurance policy item can not be anywhere close to the dividend price for the policy.

Infinite Life Insurance

To offer a very fundamental and theoretical instance, allow's assume a person is able to earn 3%, on standard, for every dollar they invest on an "infinite banking" insurance product (after all costs and costs). If we think those dollars would certainly be subject to 50% in taxes amount to if not in the insurance policy product, the tax-adjusted price of return can be 4.5%.

We presume higher than typical returns on the whole life item and an extremely high tax obligation price on bucks not take into the plan (that makes the insurance policy product look better). The fact for lots of folks may be worse. This fades in comparison to the lasting return of the S&P 500 of over 10%.

Infinite banking is an excellent product for agents that sell insurance policy, yet might not be ideal when compared to the less costly choices (without sales individuals earning fat compensations). Right here's a malfunction of several of the other purported benefits of boundless banking and why they may not be all they're broken up to be.

Whole Life Insurance Infinite Banking

At the end of the day you are purchasing an insurance item. We love the protection that insurance coverage supplies, which can be obtained much less expensively from an affordable term life insurance policy plan. Unsettled loans from the plan might also minimize your fatality benefit, diminishing another degree of security in the plan.

The idea just functions when you not only pay the significant costs, however use additional money to buy paid-up additions. The opportunity expense of all of those dollars is significant incredibly so when you might instead be purchasing a Roth IRA, HSA, or 401(k). Also when contrasted to a taxable financial investment account and even a cost savings account, infinite banking might not supply similar returns (compared to spending) and comparable liquidity, access, and low/no cost structure (compared to a high-yield interest-bearing accounts).

With the rise of TikTok as an information-sharing platform, monetary recommendations and approaches have actually discovered a novel method of spreading. One such approach that has actually been making the rounds is the boundless financial idea, or IBC for brief, amassing endorsements from celebs like rapper Waka Flocka Flame. However, while the technique is presently popular, its roots map back to the 1980s when financial expert Nelson Nash presented it to the globe.

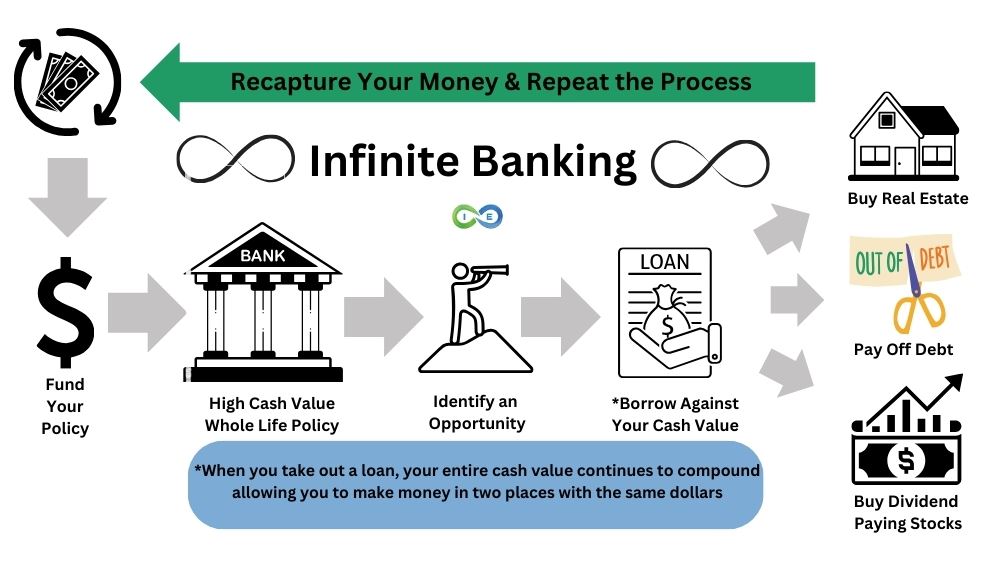

Within these plans, the cash worth expands based upon a rate set by the insurance firm. Once a significant cash money worth builds up, insurance holders can obtain a money worth funding. These financings vary from traditional ones, with life insurance coverage serving as security, implying one could shed their insurance coverage if loaning exceedingly without sufficient cash value to support the insurance prices.

Paradigm Life Infinite Banking

And while the allure of these policies is noticeable, there are innate constraints and dangers, necessitating diligent money worth monitoring. The method's authenticity isn't black and white. For high-net-worth people or entrepreneur, particularly those utilizing strategies like company-owned life insurance (COLI), the benefits of tax breaks and substance development can be appealing.

The allure of boundless banking doesn't negate its difficulties: Price: The fundamental demand, an irreversible life insurance plan, is costlier than its term equivalents. Eligibility: Not everybody certifies for entire life insurance policy because of strenuous underwriting procedures that can omit those with particular health or way of living conditions. Complexity and danger: The elaborate nature of IBC, combined with its dangers, might deter lots of, specifically when simpler and much less dangerous options are readily available.

Designating around 10% of your monthly revenue to the policy is simply not feasible for most people. Component of what you review below is merely a reiteration of what has currently been claimed over.

So prior to you obtain into a circumstance you're not planned for, know the adhering to initially: Although the concept is generally sold therefore, you're not really taking a funding from on your own - start your own bank free. If that were the case, you wouldn't need to repay it. Rather, you're borrowing from the insurance coverage company and have to settle it with passion

Synchrony Bank Infinite Credit Card

Some social media messages recommend utilizing money worth from whole life insurance coverage to pay down credit history card financial debt. When you pay back the loan, a portion of that rate of interest goes to the insurance policy company.

For the initial numerous years, you'll be paying off the payment. This makes it incredibly difficult for your policy to accumulate value throughout this moment. Whole life insurance policy expenses 5 to 15 times extra than term insurance. Lots of people merely can not manage it. So, unless you can afford to pay a few to a number of hundred bucks for the next years or more, IBC will not help you.

If you call for life insurance policy, here are some beneficial tips to think about: Think about term life insurance policy. Make certain to go shopping about for the ideal rate.

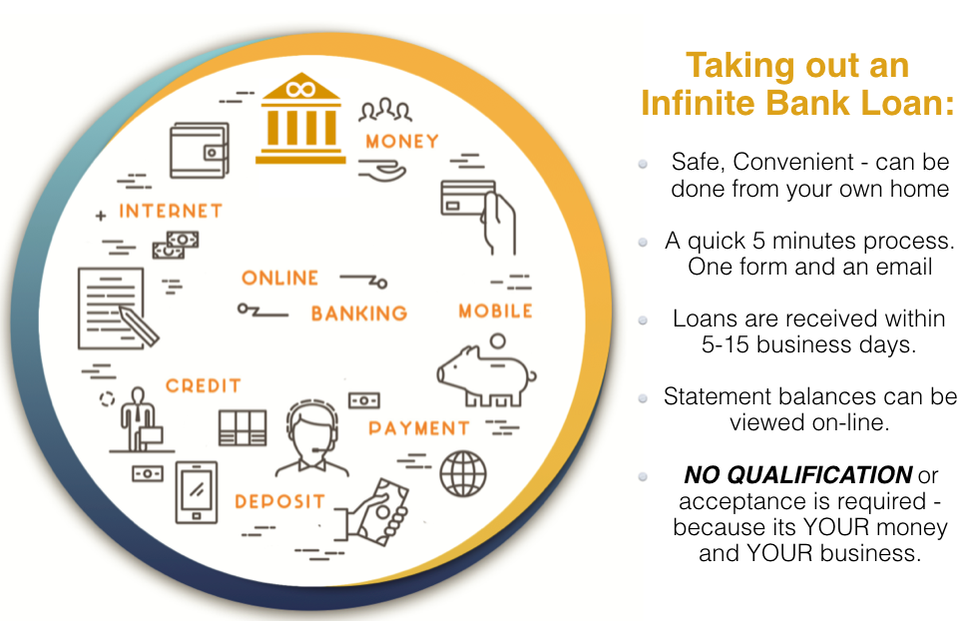

Limitless banking is not a product and services supplied by a certain establishment. Infinite banking is an approach in which you acquire a life insurance policy plan that collects interest-earning money value and obtain financings versus it, "borrowing from yourself" as a resource of capital. At some point pay back the car loan and start the cycle all over again.

Pay policy costs, a portion of which develops money worth. Take a financing out versus the plan's cash worth, tax-free. If you use this concept as meant, you're taking cash out of your life insurance plan to acquire everything you would certainly require for the rest of your life.

Latest Posts

Is "Becoming Your Own Banker" A Scam? (2025)

Help With “Becoming Your Own Banker” Criticism

Infinite Banking Institute